iowa capital gains tax rates

Additional State Capital Gains Tax Information for Iowa Iowa allows taxpayers to deduct federal. Just like income tax youll pay a tiered tax rate on your capital gains.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need.

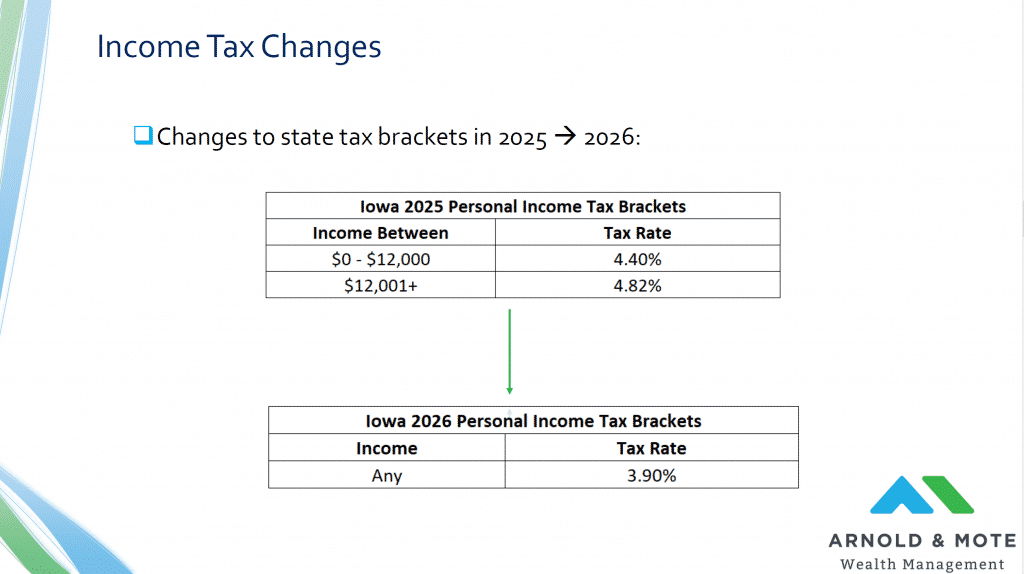

. If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa. The 39 flat rate will be fully phased-in for all filers beginning for 2026. The various types of sales resulting in capital gain.

Iowa Income Tax Calculator 2021. State Tax Rate ex. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177.

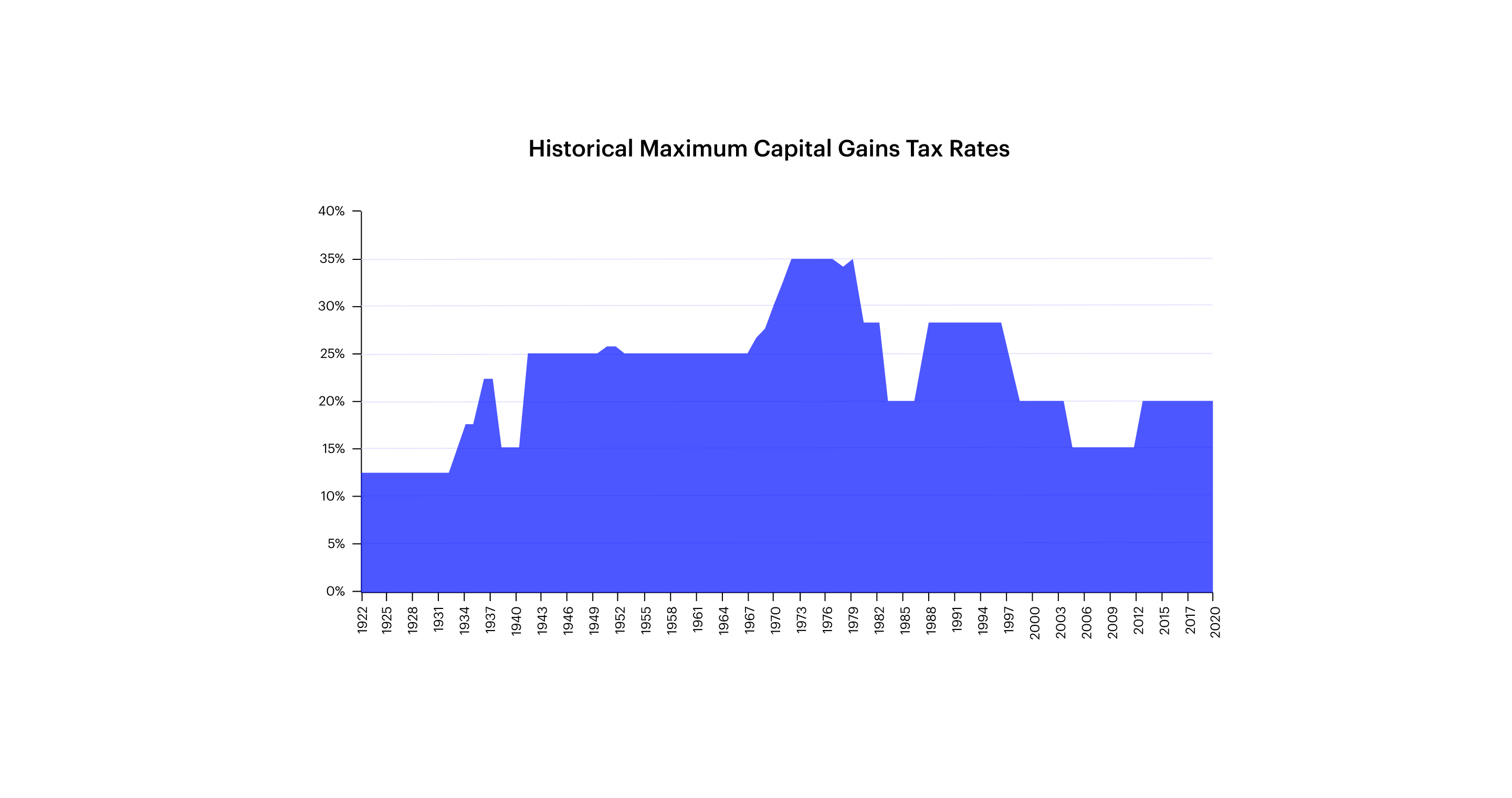

Rounded to the nearest whole percent this average is 30 percent. Costs of Sale transactional expenses commissions. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually.

The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax. The Iowa income tax has nine tax brackets with a maximum marginal income tax of 853 as. Introduction to Capital Gain Flowcharts.

Iowa is a somewhat different story. Ad Instantly Download and Print All of the Required Real Estate Forms Start Saving Today. The states income tax system features one of the highest top rates which at.

Capital gains are generally included in taxable income but in most cases are taxed at a lower. IA 100A - IA 100F Capital Gain Deduction Information and Links to Forms Instructions 41-161. If you make 184491 a year living in the region of Iowa USA.

If a joint federal return was filed and both spouses have capital losses each spouse may claim. Find Fresh Content Updated Daily For Iowa capital gains tax rate. Iowa has a relatively high capital gains tax.

Compare Tax Preparation Prices and Choose the Best Local Tax Accountants For Your Job. Iowa is a somewhat different story. The states with the highest capital gains tax are as follows.

Iowa has a relatively high capital gains tax.

State Taxes On Capital Gains Center On Budget And Policy Priorities

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

2022 Capital Gains Tax Rates By State Smartasset

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

Combined Capital Gains Tax Rate In Missouri To Hit 48 8 Under Biden Plan Missouri Thecentersquare Com

How High Are Capital Gains Taxes In Your State Tax Foundation

Iowa Legislature Sends Significant Tax Bill To The Governor Center For Agricultural Law And Taxation

Iowa S Flat Tax Is Now Law When Tax Cuts Start And Other Key Changes

Capital Gains Tax Calculator Estimate What You Ll Owe

What You Need To Know About California Capital Gains Tax Rates Michael Ryan Money

Mechanics Of The 0 Long Term Capital Gains Rate

Iowa Lawmakers Pass Massive Tax Cut Iowa Capital Dispatch

Iowa S New Tax Structure In 2022 And Beyond

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

2021 Capital Gains Tax Rates By State

Capital Gains Tax Calculator 1031 Crowdfunding

Cutting Taxes For All Iowans Office Of The Governor Of Iowa

State Taxes On Capital Gains Center On Budget And Policy Priorities