which states have a renters tax credit

43533 or less if your filing status is single or marriedregistered domestic partner RDP filing separately. LIHTC owners are prohibited from evicting residents or refusing to renew leases or.

Firewall Icon Technology Icon Icon Creative Sketches

Which states have a renters tax credit.

. Renters tax credit based on income California. There is not a rent deduction or credit on your Federal return. The Florida Tax Credit Scholarship Program for Commercial Rental Property authorizes the tenant of a commercial rental property to receive a credit against the state sales tax due on rent or.

The Low-Income Housing Tax Credit LIHTC program helps create affordable apartment communities with lower than market rate rents by offering tax incentives to the. 1 Best answer. Click to see full.

Michigan renters are eligible to receive state income tax reductions on the rental fees they paid during the year to their landlords. A national cap of 5 billion would allow states to use the Renters Credit to assist about 12 million families. The New York City enhanced real property tax credit can get renters a credit of up to 500 if they made less than 200000.

3 Tax Credit Eviction. The rebate can be up to 250 125 if married filing separately and can be claimed when you file your state tax return. If your state has anything for renters you will be prompted to enter your.

Check if you qualify. Since then median rent in the state has more than quintupled according to Glazers office. States would allocate credits based.

If you have additional questions regarding the Renters Tax Credit please contact the Departments Renters Tax Credit Program at sd atrentersmarylandgov or 410. But a new project-based renters tax credit could help a substantial number of the lowest-income renters including low-wage workers and poor seniors and people with. If you have additional questions regarding the Renters Tax Credit please contact.

Allocation of credits by states. The renters tax credit was established in 1972 and has increased just once in 1979. The majority of states that offer renters tax credits have very specific income parameters.

However a married couple filing separate. 87066 or less if you are marriedRDP filing jointly head of. The maximum amount of Nebraska affordable housing tax credits awarded to all qualified developments in any given allocation year shall be no more than 100 of the total amount of.

IR-2020-136 July 1 2020 In response to the ongoing COVID-19 pandemic the Internal Revenue Service today issued Notice 2020-53 to provide tax relief to issuers operators. Married filing separate taxpayers are limited to a rent deduction equal to 50 of the rent each pays and cannot exceed 1500 per return. 12 percent if qualifying child under age 3 Yes.

This is a refund credit which means that you will receive a refund on your state income tax filing at the end of each year that you qualify. New York NY offers a credit to renters who fulfill all of these. Their reductions are tax credits -- not tax deductions.

Thats because these programs help ease the financial burden of low-income. Tenants living in tax credit buildings have good cause eviction protection statewide. The majority of states that offer renters tax credits have very specific income parameters.

June 7 2019 310 PM. The catch is that you must file a couple of special. And with the hard work of.

With an average of 233 individuals per household assisted the state program has kept more than 720000 adults children and seniors in their homes. As far as I know the states that have anything for rent are Vermont Michigan MaineMaryland Massachusetts Minnesota Missouri New Jersey Rhode Island California Hawaii Indiana Iowa Arizona Wisconsin and Connecticut.

Trends In Apartment Renting Infographic Rent Infographic Rental Property Management Infographic

Homeowners Costs Insurance Insurance Infographic Home Ownership Homeowners Insurance Home Safety Tips

A Month To Month Rental Agreement Or Lease Agreement Is A Legally Binding Contract Rental Agreement Templates Lease Agreement Lease Agreement Free Printable

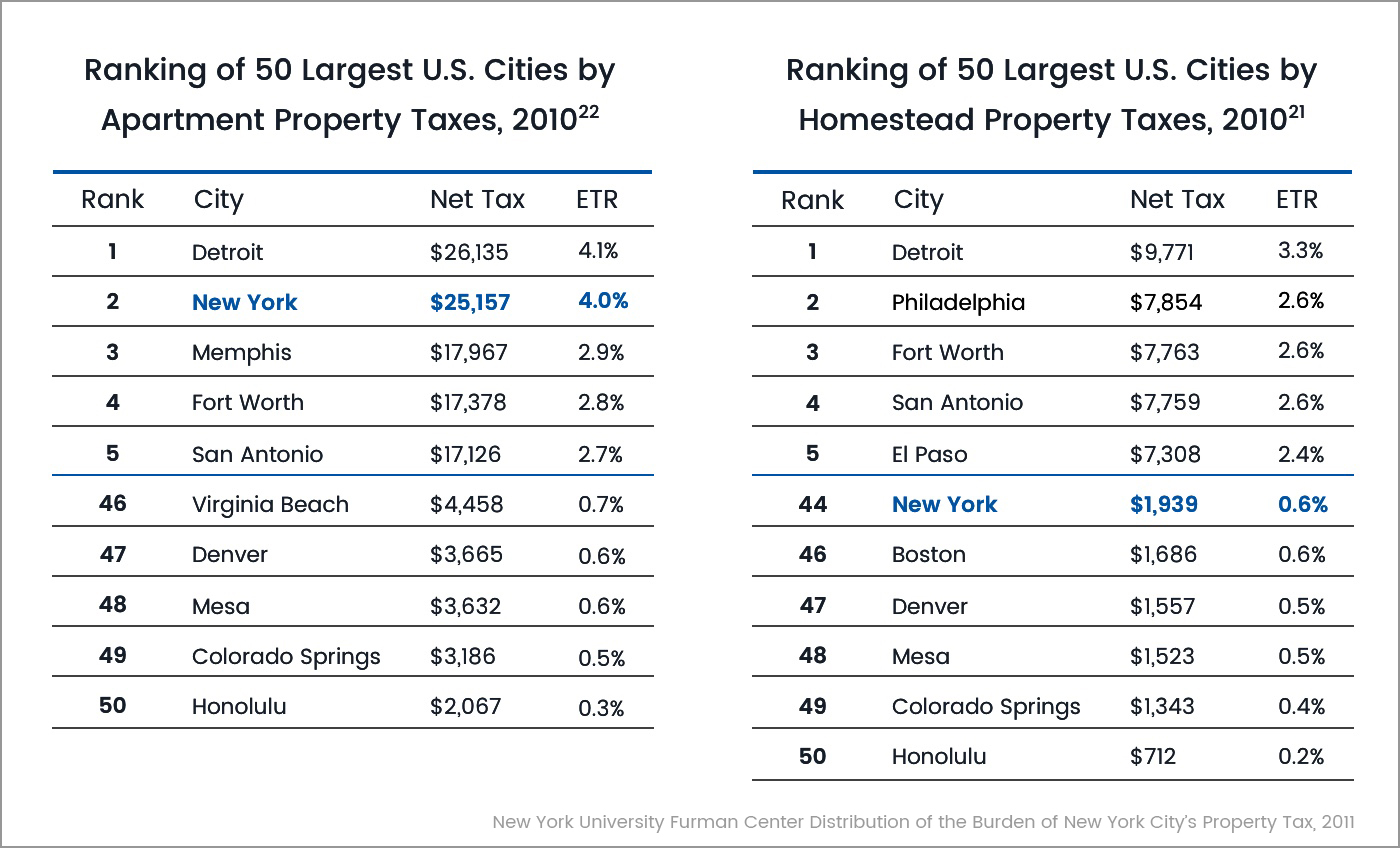

Issue 3 New York City Renters Bear A Larger Burden Of The Property Tax Tax Equity Now

Here Are The States That Provide A Renter S Tax Credit Rent Com Blog

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

5 Reasons Landlords Should Use Cozy British Sign Language Sign Language Sign Language Interpreter

Pin By Moon On Google Play Store1 Wedding Checklist Printable Wedding Planning Checklist Name Change Checklist

Purchasing A Home Is More Than Just The Initial Downpayment Between Utilities A Downpa Anzahlung Erstes Eigenheim Initialen

Pin By Alice Zhou On Pic Mario Characters Character Fictional Characters

Homebuying Vs Renting A Cost Comparison 30 Year Mortgage Mortgage Payment Rent

Here Are The States That Provide A Renter S Tax Credit Rent Com Blog

11 States That Give Renters A Tax Credit

How The U S Became A Nation Of Renters When The Housing Bubble Burst Several Million Americans Went From Being Owners Renter Infographic Real Estate Website

Here Are The States That Provide A Renter S Tax Credit Rent Com Blog

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Rent Receipt Free Printable Www Rc123 Com Free Receipt Template Receipt Template Being A Landlord